Resolving family legal issues can be stressful and complicated. Emotions run high, and it can be difficult to see the matter clearly. You need objective legal counsel from an experienced family attorney. Call the Law Office of John Williams in Charlotte, NC. John Williams can assist you if you're filing for divorce. He also handles child custody and guardianship cases.

Arrange for a consultation with a divorce attorney in Charlotte, NC today.

State Issues

The Stark Divide

The Stark Divide

by Colorado Representative Larry Don Suckla

and Michael J Badagliacco, "MJB"

Colorado's Energy Tax Divide: A Tale of Two Futures

Colorado's energy policy stands as a vivid illustration of a state grappling with its past and future. As of July 25, 2025, the tax treatment of traditional oil and gas industries versus renewable solar energy reveals a deliberate and striking contrast. The state's approach, which heavily taxes fossil fuels while offering generous exemptions for solar, underscores its commitment to a clean energy future. However, this policy divergence raises critical questions about fairness, economic stability, and the sustainability of Colorado's energy landscape. To fully understand the implications, we must examine the details of these policies, their impacts on communities, and the broader economic and environmental stakes.

The oil and gas industry in Colorado faces one of the most burdensome tax structures in the state. The property tax on oil and gas production is assessed at 87.5 percent of the gross sales value at the wellhead, a rate far exceeding that applied to other property types. This tax is calculated by multiplying 87.5 percent of the gross sales value, revenue from oil and gas sales before deductions for transportation or processing, by the local mill levy, which varies by county and includes contributions from numerous local authorities such as school districts, fire districts, and municipalities. In Weld County, for example, over 300 taxation authorities complicate the distribution of these revenues, ensuring that funds are spread across a wide array of public services. This high tax rate is designed to keep revenue in the communities where extraction occurs, compensating them for the environmental and social impacts of drilling.

Recent legislative changes have further refined this structure. HB 22-1391, passed in 2022, altered the severance tax credit for oil and gas producers starting in 2025. Previously, producers could claim a credit equal to a percentage of property taxes paid to local governments. The new law shifts this to a percentage of each well's current-year gross income multiplied by the previous year's mill levy. HB 23-1272, enacted in 2023, delayed this change to 2026 and adjusted the credit rate to 65.625 percent of gross income (75 percent of the 87.5 percent assessment rate) in 2026, rising to 76.56 percent in 2027 and beyond. These adjustments aim to balance local revenue needs with state-level priorities, particularly decarbonization. Notably, HB 23-1272 mandates that additional severance tax revenue from the reduced credit be deposited into the Decarbonization Tax Credits Administration Cash Fund, administered by the Colorado

Energy Office and the Department of Revenue to support income tax credits for decarbonization initiatives.

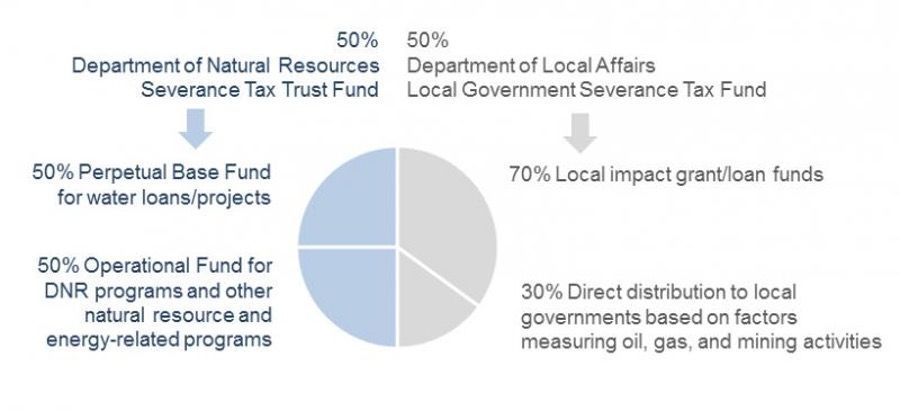

The allocation of severance tax revenue further illustrates the state's priorities. The revenue is split evenly between the Department of Natural Resources (DNR) and the Department of Local Affairs (DOLA). DNR's share goes to the Severance Tax Trust Fund, which is divided into the Perpetual Base Fund and the Operational Fund. The Perpetual Base Fund finances loans for state water projects, such as flood control, water supply, and recreational facilities, administered by the Colorado Water Conservation Board. The Operational Fund supports DNR programs, including the Colorado Oil and Gas Commission, the Avalanche Information Center, and wildlife conservation efforts. Meanwhile, DOLA's share is credited to the Local Government Severance Tax Fund, with 70 percent available for discretionary loans and grants to local governments impacted by mineral extraction. These funds support public facilities and services, while the remaining 30 percent is distributed directly to local governments based on factors like energy industry employment and mineral production.

In stark contrast, solar energy enjoys a remarkably favorable tax environment. Under Colorado Revised Statutes § 39-3-118.5, solar energy systems are 100 percent exempt from property taxes, meaning their installation does not increase a property's assessed value for tax purposes. This exemption applies to both residential and commercial installations, making solar an attractive investment. Additionally, the purchase of solar panels, inverters, and other components is exempt from Colorado's state sales tax, though local sales taxes may still apply depending on the jurisdiction. SB17-179, which extends limits on fees for solar installations, ensures that permitting and related costs remain low, further reducing barriers to adoption. These policies are part of Colorado's broader strategy to incentivize renewable energy, supported by initiatives like Xcel Energy's net metering program, which credits solar system owners for excess electricity fed back into the grid, and the Solar Rewards program, which provides rebates to offset installation costs.

The contrast between these tax treatments is stark. Oil and gas producers face an 87.5 percent tax rate on wellhead revenue, while solar installations face no production tax and benefit from property and sales tax exemptions. This disparity is intentional, reflecting Colorado's commitment to its 2040 goal of 100 percent renewable energy. The state aims to accelerate the transition to clean energy while offsetting the environmental costs of fossil fuels. Severance tax revenue from oil and gas supports critical programs, including water conservation, low-income energy assistance, and local infrastructure. However, the industry argues that the high tax burden discourages investment, potentially stifling economic growth in regions dependent on extraction, such as Weld County, where oil and gas are economic mainstays.

Proponents of the current policy argue that taxing oil and gas heavily while incentivizing solar is both environmentally and economically sound. The revenue from fossil fuels supports communities impacted by drilling, while solar exemptions reduce barriers to clean energy adoption, aligning with global climate goals. Colorado's push for decarbonization, exemplified by the Decarbonization Tax Credits Administration Cash Fund, aims to reduce greenhouse gas emissions and meet ambitious targets. By exempting solar from property and sales taxes, the state lowers the financial burden on homeowners and businesses, encouraging widespread adoption. Programs like net metering and rebates further enhance the economic case for solar, making it a viable option for Coloradans seeking to reduce their energy costs and environmental footprint.

Critics, however, see an imbalance in this approach. The high tax rate on oil and gas, they argue, risks alienating an industry that employs thousands and powers much of the state's economy. Rural communities, particularly those in extraction-heavy regions, rely on the revenue and jobs generated by oil and gas. The severance tax, with its complex allocation to trust funds and local grants, ensures that these communities see tangible benefits from the industry. Solar, while growing, does not yet provide the same scale of direct fiscal support to these regions. Critics contend that the state's tax exemptions for solar create a perception of favoritism, potentially deepening the economic divide between urban areas, where solar adoption is more common, and rural areas dependent on fossil fuels.

The economic implications of this policy divide are profound. Oil and gas taxes provide a lifeline for local governments, particularly in rural areas like Weld County, where mineral extraction drives economic activity. The severance tax funds critical infrastructure, schools, and public services, ensuring that communities bear the brunt of extraction receive compensation. Solar, while contributing to energy cost savings and environmental goals, does not yet offer the same level of direct economic support to these regions. As Colorado pushes for decarbonization, it must grapple with how to replace the revenue and jobs tied to fossil fuels without leaving rural economies behind. The transition to a renewable energy future, while necessary, risks exacerbating economic disparities if not carefully managed.

Moreover, the policy raises questions about long-term sustainability. Colorado's reliance on oil and gas revenue to fund public services creates a paradox: the state is taxing fossil fuels heavily to support decarbonization, yet it depends on those same revenues to maintain critical programs. As oil and gas production declines, either due to market forces or policy pressures, the state must find alternative revenue sources to replace the severance tax funds. Solar, while promising, does not currently generate equivalent tax revenue, and its exemptions limit its fiscal contributions. This creates a potential shortfall that could strain local budgets, particularly in rural areas.

To address these challenges, Colorado must adopt a more balanced approach. A gradual transition that includes targeted tax relief for oil and gas producers adopting cleaner practices, such as methane capture or carbon sequestration, could ease the burden on the industry while aligning with environmental goals. Simultaneously, expanding solar incentives to include workforce training programs in rural areas could ensure that the clean energy boom benefits all Coloradans. For example, investing in retraining programs for oil and gas workers to transition into solar installation or maintenance roles could bridge the economic gap between the two industries. Such initiatives would create a more inclusive energy transition, ensuring that rural communities are not left behind.

Furthermore, Colorado could explore innovative funding mechanisms to replace declining oil and gas revenues. For instance, a modest production tax on large-scale solar farms, carefully calibrated to avoid discouraging investment, could generate revenue for local governments while maintaining the state's commitment to renewables. Alternatively, expanding the Decarbonization Tax Credits Administration Cash Fund to support broader community development projects could help offset the economic impacts of reduced fossil fuel activity.

The divide between oil and gas taxation and solar exemptions tells a story of a state in transition. Colorado's commitment to a renewable energy future is commendable, but the path forward requires careful navigation. The state's policies must balance environmental ambitions with economic realities, ensuring that both urban and rural communities benefit from the shift to clean energy. By addressing the concerns of the oil and gas industry while expanding opportunities in the solar sector, Colorado can create a more equitable and sustainable energy policy. This approach would honor the state's climate goals while preserving the economic foundation that supports its diverse communities. The future of Colorado's energy landscape depends on finding this balance, a challenge that will define the state's legacy for generations to come.